GANYC Liability Insurance

[UPDATE: Additional signups no longer available for 2024. Stay tuned for 2025 info.]

2024 Premiums are here. Coverage is $TBA.

Please be aware of sign-up periods, and coverage effective dates (info below).

You can purchase your policy online here:

[LINK WILL RETURN IN THE LATE FALL]

Please note: In order to cover PayPal fees, the price for paying online is $TBA

If mailing a check for payment, it is only $TBA

If mailing a payment, send a check made out to GANYC to:

115 Broadway

5th Floor

New York, NY 10006

To be insured for the full 2024 year, you must sign up before January 24 (with full $TBA rate).

Other sign-up period:

For coverage effective only July 1-December 31 2024, payment is $TBA and due by July 31.

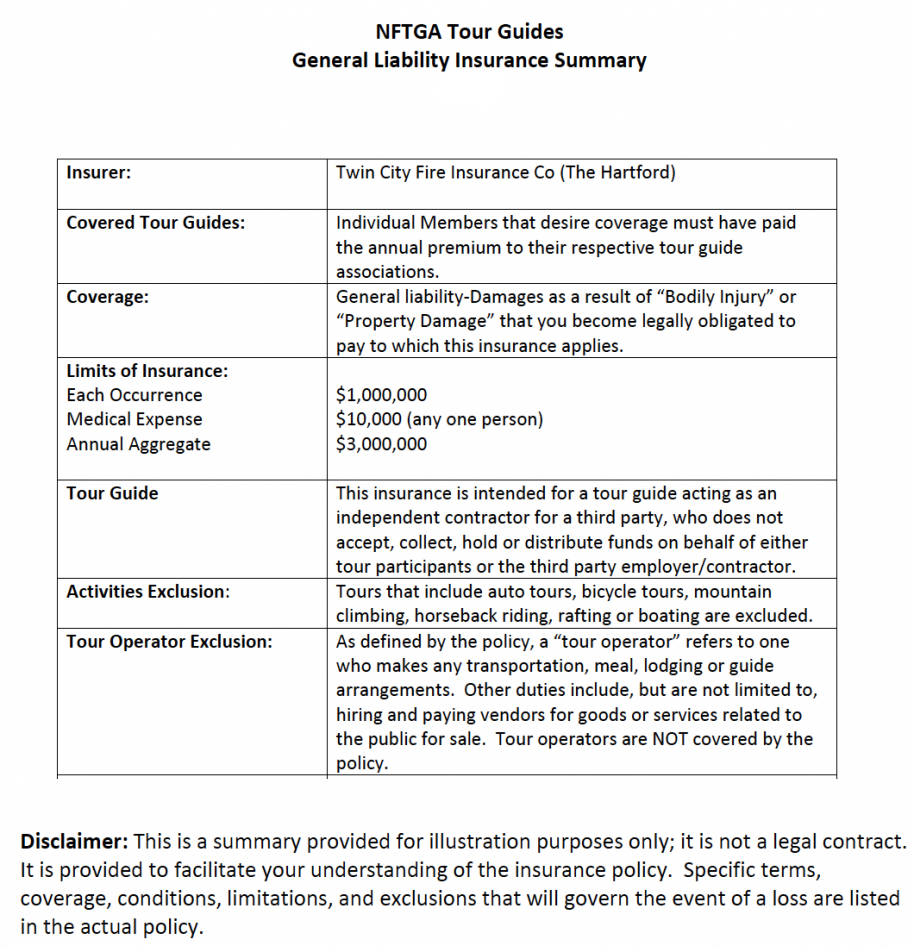

Here is a summary of the policy:

What You Need to Know About Renewing the NFTGA Liability Insurance Policy

For years the unavailability of affordable Personal Liability Insurance for many NFTGA member guides was an issue of concern. Several larger guide associations (Washington DC, New Orleans, New York) purchased policies to protect their members from exposure to negligence lawsuits, but the cost was considered too burdensome for most of our Member Associations.

But in 2007, the NFTGA arranged for a broker to write a policy that allowed the guide members from all NFTGA Member Associations uninsured at the time into one group.

Your questions about the coverage have been organized into this one document, along with answers from the insurance agent. We invite you to contact NFTGA insurance coordinator with any unaddressed concerns.

A timetable listing the course of action to put the policy in effect for those who did not enlist by January 1, or are new to NFTGA, follows this Q & A section.

Q. Who can be covered by this policy?

A. The easy answer would be Independent Contractor (IC) Tour Guides. But the diversity of terms in this industry, and how each association understands the terms, requires a more descriptive answer.

You would be covered by this policy while performing duties as a Tour Guide, Step-On Guide, Tourist Guide, Tour Escort, Meet and Greet, IC (Independent Contractor) and possibly as a TD, Tour Director, Trip Director, Tour Manager, Travel Manager. (See Primary Exceptions below.)

You would be covered by this policy while working for – but not as - a DMC (Destination Management Company), Meeting Planner, Tour Operator, Wholesale Tour Operator, Tour Organizer, Tour Planner, Tour Company, Transportation Company, Museum, Receptive Travel Service, Travel Company, Event Planner, Production Company and others.

You would also be covered for walking or step-on tours resulting from self-promotion, such as advertising your services on the internet or elsewhere. The key here is that you would NOT be providing transportation, meals, or lodging.

Primary Exceptions:

You would not be covered if you are a/the tour operator, DMC, etc., who planned, organized and sold the tour, event or meeting to the public. If you are in the business of planning, organizing or selling tours to the public (or private individuals) this insurance is not for you. This insurance is not Professional Liability insurance.

Q. You said the policy doesn’t cover people who plan their own tours. But ICs in most of the world do plan their own tours. We are hired as ICs to provide tours for companies who have sold them to the public as (for instance) City Highlights Tour, Neighborhoods Tour, Architecture Tour. Rarely do DMCs and tour operators have enough in-depth knowledge to plan a guided tour. We are the ones who plan our tour, decide the route and what to say.

A. While you may plan the routing and decide the commentary for the tour, you are considered an Independent Contractor if you are not generating your own income stream. Generally, a DMC or other entity must pay the bills associated with the tour (meal, motor coach, guide) and you must “just” make it work while you are representing their company. Essentially, you are considered an Independent Contractor if you are paid by a third party for your work.

Q. How can I tell if I am working for a DMC as an employee, or as an IC (Independent Contractor)?

A. Look at your paycheck. If no taxes have been deducted or the company traditionally sends you a Form 1099 with your earnings each January, you are probably working for them as an IC. If income taxes have been withheld and the company traditionally sends a W-2 Statement at tax time, you are most likely working for them as an employee.

Q. If I am employed as a full-time or part-time tour director by one tour operator (they withhold taxes) but I am not covered by their insurance, can I purchase the new NFTGA policy?

A. If you only provide guide services and do not engage in the operations/planning activities for the tour operator, this policy would cover your guide activities.

Q. Let’s say I help design tours for a DMC on a consulting basis, and that tour is later included among my assignments. Am I covered while guiding that tour, even though I was not involved in the final composition or selling of that tour?

A. You would be covered as a guide as long as you were not paid by the DMC for your consulting services.

Q. I work as an Independent Contractor for some companies and as a covered employee for others. Would the policy at least cover me when I am on assignment as an IC?

A. Yes

Q. I work as an Independent Contractor, but my jobs take me to other parts of the U.S. or out of the country (a trip to Hawaii, a student tour to Canada, a study trip to Europe, a Senior trip to Europe). If all other qualifications are met, will the policy cover me in all these circumstances?

A. You would be covered only in the U.S.

Q. I work in tourism, but there is no guide association in my area. Can I become an NFTGA Friend Member and be eligible for this coverage?

A You must be a member of one of our Member Associations and your association must be a member of the NFTGA. You will lose your coverage if your membership in your local association – or their membership in the NFTGA - lapses or is terminated for any reason.

Q. Can our Canadian guide colleagues be included in this deal or is this a USA thing only?

A. USA guide associations only.

Q. In our area of the country ICs often guide tours that involve horseback riding, bike riding, Segway, hiking and other potentially risky activities. Would my guiding for those types of employers be covered under the terms of the NFTGA policy?

A. This policy is not intended for that type of exposure. There will be a clause in the policy restricting coverage to walking, motor coach, mass transit, auto or taxi transportation.

Q. It seems there has rarely, if ever, been a circumstance where the insurance company has had to pay a claim for any of the associations currently covered by similar policies. What would happen if the entire $3,000,000 aggregate coverage is exhausted before the end of the policy year? Are we out of luck for the rest of the year?

A. If circumstances drain the fund before the end of a policy year, your group would need to renew their coverage by purchasing a new 12-month policy.

Q. Would this policy be in effect for Tour Managers or Tour Directors, like members of IATM and graduates of IGA and ITMI who lead multi-day tours across state lines, or even to foreign countries?

A. Tour Managers and Tour Directors not involved in the organizing, promoting or selling of a tour would be covered for that tour – but not on tours outside the US. They would also not be covered by this policy if they were covered by their employers insurance.

Q. What if, at the request of the tour company/DMC who has hired me, I pay for a taxi, van, restaurant, etc., with my cash or my personal credit card and something untoward happens? Would that be considered as “being involved in tour operations” and would coverage potentially be denied?

A. Yes, coverage would be denied under those circumstances.

Q. Periodically someone contacts me directly to do a tour. No DMC or tour operator is involved, but I do the same guided tour that I would if I had been hired through a DMC. The group leader provides their own transportation and driver, and they pay all the bills at the venues they want to visit during the tour. Basically, this is a “step-on” situation, but no middle-man is involved. Would this type of circumstance be covered if I purchase this policy?

A. Yes, coverage would apply.

Q. I sometimes volunteer to lead tours, as a “Greeter” or for a local museum, historical or architectural foundation. Even if no one is paying me, would I be covered by this policy if something were to happen on tour?

A. Your homeowners policy may provide coverage for unpaid volunteer work. The NFTGA coverage would apply otherwise.

~~~~~~~~~~~

We suggest you check with the companies that hire you, to see if their personal liability insurance covers you while you are working for them. You should also check with your insurance agent to see if your business and commercial activities are included in your auto, homeowners or umbrella policies.

You will almost certainly learn that your guiding activities are excluded and all your personal assets are at risk if you would be named in a lawsuit. Without personal liability insurance, you also risk spending a small fortune for legal representation, even if your name is later removed from the legal action.

Disclaimer: The NFTGA has negotiated this policy as a service for our members but receives no commission and accepts no responsibility as an insurance broker. This document was prepared to provide information for NFTGA members in their search for tour guide personal liability insurance. It is not intended to be an endorsement nor a comprehensive guide to the policy under consideration. Neither the NFTGA nor the author assumes responsibility for any errors or omissions.

[NOTE:

If you need a higher level of tour operator insurance, contact AON:

https://www.aontravpro.com/ ]